The best insurance company in Canada is often considered to be Manulife. It offers a wide range of coverage options.

Manulife is a well-established leader in the Canadian insurance market. They provide various products, including life, health, and travel insurance. Their comprehensive services cater to both individuals and businesses. Manulife’s strong financial stability ensures reliable support for policyholders. Their customer service is highly rated, making them a trusted choice.

The company continually innovates, offering digital tools for easy policy management. Competitive pricing and flexible plans add to their appeal. Many Canadians choose Manulife for its robust coverage and excellent service. This makes Manulife a top contender for the best insurance company in Canada.

Criteria For Evaluation

Choosing the best insurance company in Canada requires specific criteria. These criteria help ensure you select a company that meets your needs. Here are the key criteria for evaluation:

Financial Stability

Financial stability is crucial for any insurance company. A stable company can pay claims promptly. Look for companies with high ratings from agencies like Standard & Poor’s or Moody’s. These ratings indicate the company’s ability to meet its financial obligations.

Here are some aspects to consider:

- Company’s credit rating

- Annual financial reports

- Solvency ratio

Customer Service Quality

Good customer service enhances your experience with the insurance company. A company with excellent customer service is responsive and helpful. They should offer multiple channels for support, such as phone, email, and live chat.

Consider these factors:

- Response time for queries

- Availability of support channels

- Customer reviews and testimonials

Coverage Options

The variety of coverage options is another important criterion. The best insurance company offers flexible and comprehensive plans. They should provide coverage for different needs, including health, auto, and home insurance.

Look for these options:

- Range of insurance products

- Customization of plans

- Additional benefits and riders

Top Life Insurance Companies

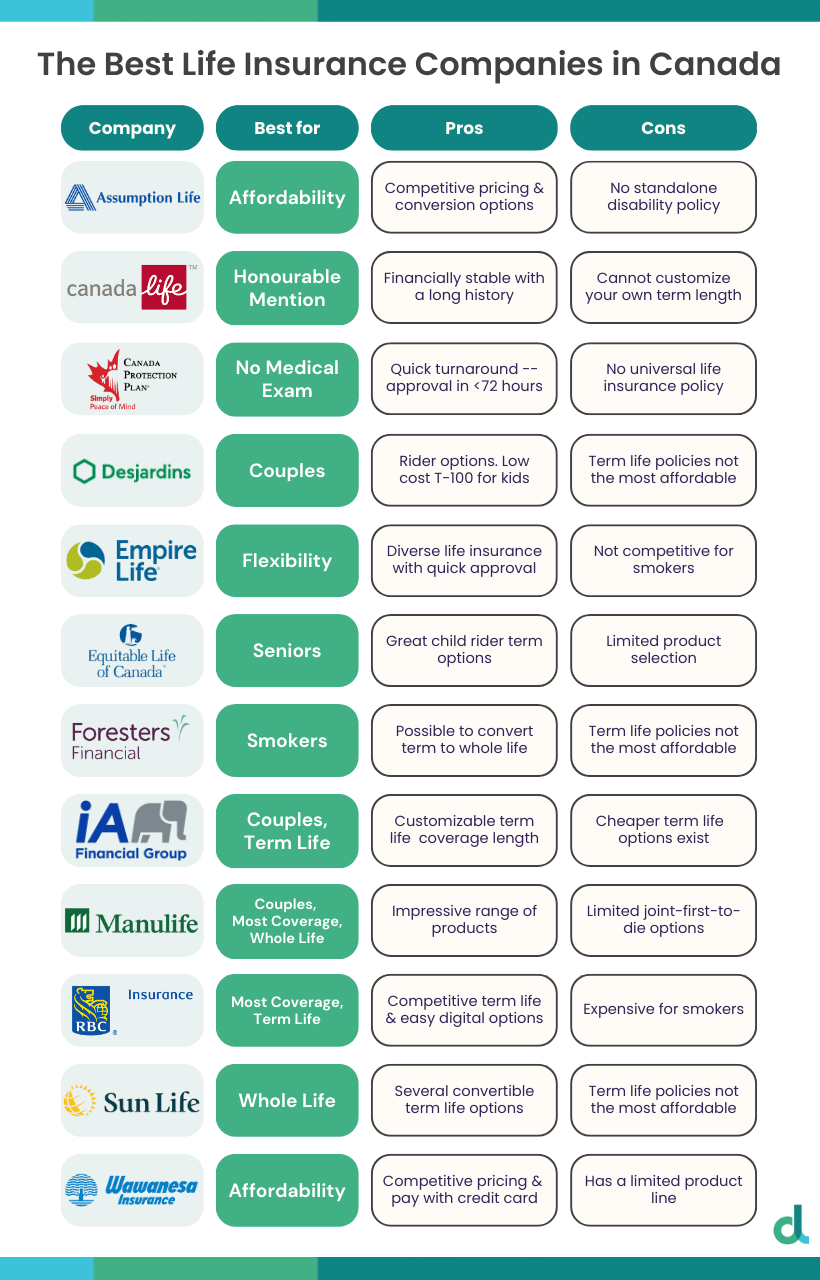

Choosing the best life insurance company in Canada is vital. It ensures your loved ones are financially secure. Below are some of the top life insurance companies in Canada.

Company A Overview

Company A is well-known for its customer service and competitive rates. It offers a wide range of life insurance products.

- Term Life Insurance: Affordable and straightforward.

- Whole Life Insurance: Provides lifelong coverage.

- Universal Life Insurance: Offers flexible premiums and investment options.

Company A has received high ratings from customers. They appreciate the easy claim process and helpful agents.

Company B Overview

Company B is another leading life insurance provider. It is known for its innovative policies and customer satisfaction.

- Term Life Insurance: Cost-effective and simple.

- Whole Life Insurance: Permanent coverage with cash value.

- Critical Illness Insurance: Coverage for serious health conditions.

Company B’s policies are flexible. They can be customized to meet different needs. Customers praise the company for its transparency and fair pricing.

| Feature | Company A | Company B |

|---|---|---|

| Customer Service | Excellent | Very Good |

| Policy Options | Variety | Diverse |

| Pricing | Competitive | Fair |

| Claim Process | Easy | Simple |

Both companies offer strong life insurance options. Choose the one that best fits your needs.

Top Auto Insurance Companies

Auto insurance is crucial for every car owner. Choosing the right company can save you money and provide peace of mind. Below, we explore some of the top auto insurance companies in Canada. Discover what makes them stand out.

Company C Overview

Company C has built a strong reputation over the years. They offer comprehensive auto insurance policies that fit different needs. Here are some key features:

- Affordable premiums for various vehicle types

- 24/7 customer support

- Quick and easy claims process

- Multiple discount options

| Feature | Details |

|---|---|

| Coverage Options | Collision, Comprehensive, Liability |

| Discounts | Safe Driver, Multi-Car, Good Student |

| Claim Process | Online, Phone, App |

Company C stands out for its customer-centric approach. Their policies are flexible and cater to different budgets.

Company D Overview

Company D is another top choice for auto insurance in Canada. They are known for their reliable coverage and excellent customer service. Key highlights include:

- Customizable insurance plans to fit individual needs

- Roadside assistance included

- Accident forgiveness program

- Discounts for bundling policies

| Feature | Details |

|---|---|

| Coverage Options | Collision, Comprehensive, Liability, Personal Injury Protection |

| Discounts | Bundling, Anti-Theft, Pay-in-Full |

| Claim Process | Online, Phone, App |

Company D emphasizes customer satisfaction. They offer various discounts and have a user-friendly claim process.

Top Home Insurance Companies

Finding the best home insurance is crucial. It protects your home from unexpected events. We have listed the top home insurance companies in Canada. These companies offer great coverage and customer service.

Company E Overview

Company E is a trusted name in home insurance. They offer comprehensive coverage options and affordable premiums.

- Basic Coverage: Fire, theft, and water damage.

- Additional Coverage: Earthquake, flood, and personal liability.

- Discounts: Multi-policy, loyalty, and alarm system discounts.

| Feature | Details |

|---|---|

| Customer Service | 24/7 support with quick claims processing. |

| Online Services | Easy online quotes and policy management. |

| Mobile App | User-friendly app for policy management. |

Company F Overview

Company F is known for its tailored home insurance plans. They provide extensive coverage and excellent customer support.

- Standard Coverage: Covers fire, theft, and vandalism.

- Optional Add-Ons: Sewer backup, identity theft, and home business coverage.

- Special Discounts: Claims-free, bundling, and eco-friendly home discounts.

| Feature | Details |

|---|---|

| Customer Service | High ratings for customer satisfaction. |

| Online Services | Comprehensive online tools for easy management. |

| Mobile App | Intuitive app with all necessary features. |

Specialized Insurance Providers

Canada has many specialized insurance providers. They offer unique coverage options. This helps meet specific needs of individuals and families. Let’s explore some of the best in the business.

Travel Insurance

Travel insurance is essential for those who love to explore the world. It covers unexpected events during trips. These events can include medical emergencies, trip cancellations, and lost luggage. Some of the best travel insurance providers in Canada are:

- Manulife: Offers extensive coverage for medical emergencies and trip cancellations.

- Allianz Global Assistance: Known for their 24/7 customer support and quick claims process.

- Blue Cross: Provides comprehensive plans with options for families and seniors.

Choosing the right travel insurance can provide peace of mind. It ensures you are protected while enjoying your vacation.

Health Insurance

Health insurance is crucial for covering medical expenses. This includes doctor visits, prescriptions, and hospital stays. Some top health insurance providers in Canada are:

| Provider | Features |

|---|---|

| Sun Life Financial | Offers flexible plans with dental and vision coverage. |

| Great-West Life | Known for their comprehensive health and wellness programs. |

| Green Shield Canada | Provides affordable plans with a wide network of healthcare providers. |

Choosing the right health insurance ensures your medical needs are covered. It helps you stay healthy without worrying about costs.

Customer Reviews And Ratings

Choosing the best insurance company can be challenging. Customer reviews and ratings are helpful. They provide real experiences from actual clients. This section highlights top-rated companies and common customer complaints.

Top-rated Companies

Here are some of the best insurance companies in Canada based on customer ratings:

| Company | Rating | Features |

|---|---|---|

| Manulife | 4.5/5 |

|

| Sun Life | 4.4/5 |

|

| TD Insurance | 4.2/5 |

|

Common Customer Complaints

While many customers are happy, some have complaints. Here are some common issues:

- High Premium Costs: Some customers find the premiums expensive.

- Slow Claim Processing: Delays in claim processing frustrate clients.

- Poor Communication: Lack of clear communication causes misunderstandings.

Understanding these complaints helps in making better decisions. Choose a company that aligns with your needs and expectations.

Tips For Choosing The Best Insurance

Choosing the best insurance can be challenging. You need to consider several factors to make the right decision. Below are some valuable tips to help you find the best insurance company in Canada.

Comparing Quotes

Start by comparing quotes from different insurance companies. This helps you understand the market rates and find the best deal. Use online tools or contact insurance agents for quotes.

| Company | Coverage Options | Monthly Premium |

|---|---|---|

| Company A | Basic, Premium, Family | $50 |

| Company B | Basic, Family | $45 |

| Company C | Basic, Premium | $55 |

Pay attention to the coverage options each company offers. Some may have special plans that fit your needs better.

Understanding Policy Terms

Understanding policy terms is crucial. Read the policy documents carefully. Look for key terms and conditions that affect your coverage.

- Premium: The amount you pay for your insurance.

- Deductible: The amount you pay out of pocket before insurance covers the rest.

- Exclusions: What is not covered by the policy.

- Claim Process: How to file a claim and what documents are required.

Make sure you understand the deductible and exclusions. These can significantly impact your out-of-pocket costs. Always ask for clarification if any terms are unclear.

Frequently Asked Questions

What Are The Big 4 Insurance Companies In Canada?

The big four insurance companies in Canada are Manulife, Sun Life Financial, Great-West Life, and Intact Financial. These companies dominate the market.

What Is The Best Car Insurance In Canada?

The best car insurance in Canada varies based on individual needs. Popular options include TD Insurance, Intact Insurance, and Desjardins Insurance. Always compare quotes and coverage.

Who Is The No 1 Life Insurance In Canada?

Manulife is often considered the No. 1 life insurance provider in Canada. They offer comprehensive coverage and excellent customer service.

Which Company Is Best In Health Insurance In Canada?

Manulife is considered one of the best health insurance companies in Canada. It offers comprehensive plans and excellent customer service.

Conclusion

Choosing the best insurance company in Canada ensures peace of mind. Research and compare to find the perfect fit. Remember, the right coverage can protect your assets and loved ones. Make an informed decision and invest in a secure future today.

Your financial safety is worth the effort.