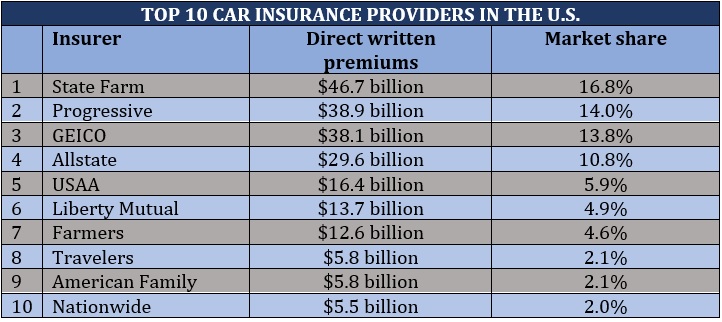

The top 10 insurance companies in the USA are State Farm, Geico, Progressive, Allstate, USAA, Liberty Mutual, Farmers, Nationwide, American Family, and Travelers. Insurance is essential for financial protection.

Understanding the best options can help you make informed decisions. The top 10 insurance companies in the USA excel in providing diverse and reliable coverage. State Farm leads with a large customer base, while Geico is known for competitive rates.

Progressive offers innovative policies, and Allstate is trusted for its comprehensive services. USAA caters to military families, and Liberty Mutual provides various coverage options. Farmers and Nationwide are popular for their customer service. American Family and Travelers round out the list with strong reputations. These companies offer a range of policies to meet different needs.

State Farm

State Farm is a household name in the insurance industry. This company has been providing quality insurance services for decades. It offers a range of insurance products to meet diverse needs. Let’s dive into the details of State Farm.

Company Overview

State Farm was founded in 1922 by George J. Mecherle. The company is headquartered in Bloomington, Illinois. It is one of the largest insurance companies in the USA. State Farm provides services through a network of agents across the country.

| Founded | 1922 |

|---|---|

| Headquarters | Bloomington, Illinois |

| Number of Agents | Over 19,000 |

| Insurance Products | Auto, Home, Life, Health, and more |

Key Features

State Farm stands out with its extensive range of insurance products. Here are some key features that make State Farm unique:

- Comprehensive Coverage Options: Auto, home, renters, life, and health insurance.

- Strong Financial Stability: A high financial strength rating.

- Customer Service: 24/7 support with a network of local agents.

- Discounts: Multiple discounts for bundling policies and safe driving.

- Mobile App: User-friendly app for policy management and claims.

State Farm’s commitment to customer service and financial stability make it a top choice. Its diverse product offerings cater to various insurance needs.

Geico

Geico, one of the largest auto insurers in the United States, stands out for its affordable rates and exceptional customer service. Founded in 1936, Geico has grown to serve millions of policyholders, offering a range of insurance products. Its catchy advertising campaigns and user-friendly mobile app have made it a household name.

Company Overview

Geico, or the Government Employees Insurance Company, started in 1936. It primarily served government employees. Today, Geico is a wholly-owned subsidiary of Berkshire Hathaway. It ranks as the second-largest auto insurer in the U.S.

| Founded | 1936 |

|---|---|

| Headquarters | Chevy Chase, Maryland |

| Parent Company | Berkshire Hathaway |

| Number of Employees | 40,000+ |

Key Features

Geico offers a variety of insurance products. These include auto, motorcycle, homeowners, and renters insurance. Its features make it a popular choice.

- Affordable Rates: Geico provides competitive pricing with numerous discounts.

- 24/7 Customer Service: Geico offers round-the-clock support.

- Mobile App: Geico’s app allows easy policy management.

- Extensive Coverage Options: Geico offers a range of coverage choices.

- Strong Financial Stability: Geico has an A++ rating from A.M. Best.

Geico’s commitment to affordability and customer service makes it a top choice for many. Its wide array of features caters to diverse needs, ensuring comprehensive coverage for policyholders.

Progressive

Progressive is a well-known insurance company in the USA. Known for its catchy commercials, Progressive offers a wide range of insurance products. They provide coverage for auto, home, and even commercial vehicles. Their innovative approach and strong customer service make them a top choice.

Company Overview

Progressive was founded in 1937. It is one of the largest car insurance providers in the USA. The company is headquartered in Mayfield Village, Ohio. Progressive offers insurance in all 50 states. They have a strong online presence and offer 24/7 customer service. Their mission is to provide affordable and reliable insurance solutions.

Key Features

- Snapshot Program: Progressive’s Snapshot program rewards safe driving.

- Bundle and Save: Customers can save by bundling multiple policies.

- 24/7 Customer Service: Available anytime for claims and support.

- Discounts: Various discounts for good drivers, students, and more.

- Mobile App: Easy access to policy details and claims via the app.

| Feature | Description |

|---|---|

| Snapshot Program | Rewards safe driving with discounts. |

| Bundle and Save | Save by combining multiple policies. |

| 24/7 Customer Service | Get help anytime, anywhere. |

| Discounts | Available for various criteria like good driving. |

| Mobile App | Manage your policies on-the-go. |

Progressive continues to innovate in the insurance industry. Their customer-first approach sets them apart. For more details, visit their website or contact their customer service.

Allstate

Allstate is one of the top insurance companies in the USA. Founded in 1931, it has grown to offer a wide range of insurance products. These include auto, home, life, and more. This section will focus on Allstate’s company overview and key features.

Company Overview

Allstate is a well-established name in the insurance industry. It serves millions of customers across the United States. The company is known for its strong financial stability and customer service. Allstate’s headquarters are in Northbrook, Illinois. The company operates through a network of agents and online platforms. This makes it convenient for customers to access services.

Key Features

Allstate offers a variety of insurance products and services. Here are some key features:

- Auto Insurance: Comprehensive coverage options for car owners.

- Home Insurance: Protects homes from various risks.

- Life Insurance: Provides financial security for families.

- Discounts: Multiple discounts available for bundling policies.

- Digital Tools: User-friendly mobile app and website for easy access.

- 24/7 Claims Support: Assistance available round-the-clock for claims.

Allstate also offers specialized insurance products. These include motorcycle, renters, and business insurance. The company focuses on customer satisfaction and innovation. It continually updates its offerings to meet customer needs.

Usaa

The USAA is a well-known insurance provider in the USA. It offers a variety of insurance products tailored to military members and their families.

Company Overview

Founded in 1922, the United Services Automobile Association (USAA) is dedicated to serving military personnel. The company is headquartered in San Antonio, Texas. USAA serves over 13 million members.

USAA provides a wide range of financial services. These services include insurance, banking, and investment products. The company is recognized for its exceptional customer service.

| Founded | 1922 |

|---|---|

| Headquarters | San Antonio, Texas |

| Number of Members | Over 13 million |

Key Features

USAA offers several key features that make it stand out. These features cater specifically to military families.

- Exclusive Membership: Available to military members and their families.

- Comprehensive Coverage: Auto, home, life, and health insurance.

- Financial Services: Banking, investment, and retirement planning.

- Discounts: Special discounts for safe driving and bundling policies.

- Mobile App: Easy policy management through a user-friendly app.

- 24/7 Customer Support: Access to support any time of the day.

- USAA aims to provide the best rates for military families.

- The company offers unique benefits tailored to military life.

Liberty Mutual

Liberty Mutual is among the top 10 insurance companies in the USA. It was founded in 1912 and is headquartered in Boston, Massachusetts. The company offers a variety of insurance products including auto, home, and life insurance.

Company Overview

Liberty Mutual is a global insurer with operations in over 30 countries. The company employs more than 45,000 people worldwide. It is one of the largest property and casualty insurers in the United States. Liberty Mutual has earned a strong reputation for its customer service and comprehensive coverage options.

Key Features

- Wide Range of Products: Auto, home, life, and more.

- Global Presence: Operations in over 30 countries.

- Customer Service: 24/7 support for policyholders.

- Discounts: Multiple discounts for bundling policies.

- Mobile App: Easy claims and policy management.

| Feature | Description |

|---|---|

| Wide Range of Products | Offers diverse insurance products. |

| Global Presence | Operations in more than 30 countries. |

| Customer Service | 24/7 support for all policyholders. |

| Discounts | Multiple discounts for bundling policies. |

| Mobile App | Easy claims and policy management. |

Farmers Insurance

In the competitive landscape of insurance in the USA, Farmers Insurance stands out as a trusted name. Founded in 1928, it has grown into one of the most reliable insurance providers. Let’s explore more about this company under the following headings:

Company Overview

Farmers Insurance offers a wide range of insurance products. These include auto, home, life, and business insurance. The company’s headquarters are located in Los Angeles, California. With over 48,000 exclusive and independent agents, they serve millions of customers across the country. Their mission is to help customers manage the risks of everyday life.

Key Features

- Customizable Coverage Options: Farmers allows you to tailor your insurance policies to fit your needs.

- 24/7 Claims Support: They offer round-the-clock claims assistance, ensuring help is always available.

- Discounts: Multiple discounts are available, including multi-policy and good driver discounts.

- Mobile App: The Farmers Insurance mobile app makes managing your policy easy.

- Financial Strength: Farmers Insurance is financially stable, providing peace of mind to policyholders.

| Feature | Details |

|---|---|

| Founded | 1928 |

| Headquarters | Los Angeles, California |

| Number of Agents | 48,000+ |

| Coverage Options | Auto, Home, Life, Business |

| Claims Support | 24/7 |

Farmers Insurance remains a top choice for many. Their customizable options, reliable support, and strong financial standing make them a leader in the industry.

Nationwide

Nationwide consistently ranks among the top 10 insurance companies in the USA. Offering extensive coverage options, it caters to diverse needs.

Nationwide is one of the leading insurance companies in the USA. It offers a wide range of insurance products and services. Nationwide has a strong presence across the country.

Company Overview

Nationwide started in 1925. It has grown to be a top insurance provider. The company serves millions of customers. It offers car, home, life, and pet insurance. Nationwide is known for its customer service and financial strength.

Key Features

| Feature | Description |

|---|---|

| Variety of Insurance Products | Nationwide offers auto, home, life, and pet insurance. |

| On Your Side® Promise | Customers get personalized support and guidance. |

| Financial Strength | Nationwide has a strong financial rating. |

| 24/7 Claims Service | File claims anytime, day or night. |

| Discounts | Customers can save with various discounts. |

- Mobile App: Manage policies and file claims on the go.

- Accident Forgiveness: Your rates won’t go up after one accident.

- Vanishing Deductible®: Reduce your deductible just by driving safely.

Nationwide is a trusted name in the insurance industry. It offers comprehensive coverage options and excellent customer service.

American Family Insurance

American Family Insurance, a well-established name, offers diverse insurance products. Known for its customer-centric approach, it has built a strong reputation over the years.

Company Overview

Founded in 1927, American Family Insurance is headquartered in Madison, Wisconsin. Initially, it focused on auto insurance for farmers. Over the years, it expanded its services to include home, life, health, and business insurance. Today, it serves millions of customers across the United States.

Key Features

- Comprehensive Coverage: Offers a wide range of insurance products.

- Customer Service: Known for excellent customer support.

- Discounts: Multiple discounts available, including safe driver and multi-policy discounts.

- Financial Strength: Strong financial ratings from leading agencies.

| Feature | Details |

|---|---|

| Founded | 1927 |

| Headquarters | Madison, Wisconsin |

| Insurance Types | Auto, Home, Life, Health, Business |

| Customer Service | 24/7 support available |

| Financial Ratings | A+ from A.M. Best |

Overall, American Family Insurance stands out for its comprehensive coverage options, strong financial backing, and excellent customer service. Customers can enjoy a variety of discounts, making it a popular choice in the insurance market.

Travelers

Travelers is one of the most respected insurance companies in the USA. Known for its reliability and comprehensive coverage options, Travelers has been serving customers for over 160 years. It offers a variety of insurance products, including auto, home, and business insurance.

Company Overview

Travelers was founded in 1864. It is headquartered in New York City. The company has a strong presence nationwide. It provides a wide range of insurance products.

Travelers employs over 30,000 people. It is committed to innovation and customer satisfaction. The company has received numerous awards for its service and products.

Key Features

- Comprehensive Coverage: Travelers offers extensive coverage options for various needs.

- Customer Service: The company is known for its excellent customer service.

- Discounts: Travelers provides multiple discounts to policyholders.

- Financial Strength: Travelers is financially strong and stable.

- Claims Process: The claims process is straightforward and efficient.

| Feature | Details |

|---|---|

| Founded | 1864 |

| Headquarters | New York City, NY |

| Employee Count | 30,000+ |

| Insurance Types | Auto, Home, Business |

Frequently Asked Questions

Who Is The #1 Insurance Company In The Usa?

State Farm is the #1 insurance company in the USA. It leads in market share and customer satisfaction.

What Are The Top 10 Life Insurance Companies?

The top 10 life insurance companies are Northwestern Mutual, New York Life, MassMutual, Prudential, State Farm, Guardian Life, Principal, Pacific Life, John Hancock, and Nationwide.

What Is The Best Insurance In The Usa?

The best insurance in the USA varies based on individual needs. Popular options include State Farm, Geico, and Allstate for auto insurance, and Blue Cross Blue Shield, UnitedHealthcare, and Kaiser Permanente for health insurance. Always compare policies to find the best fit for your requirements.

Which Are The Top Insurance Company?

Top insurance companies include State Farm, Allstate, Geico, Progressive, and Liberty Mutual. Each offers various coverage options.

Conclusion

Choosing the right insurance company is crucial for peace of mind. The top 10 insurance companies in the USA offer various benefits and coverage options. Evaluate your needs and compare policies to find the best fit. Trust in these reputable companies to safeguard your future and provide reliable support when needed.